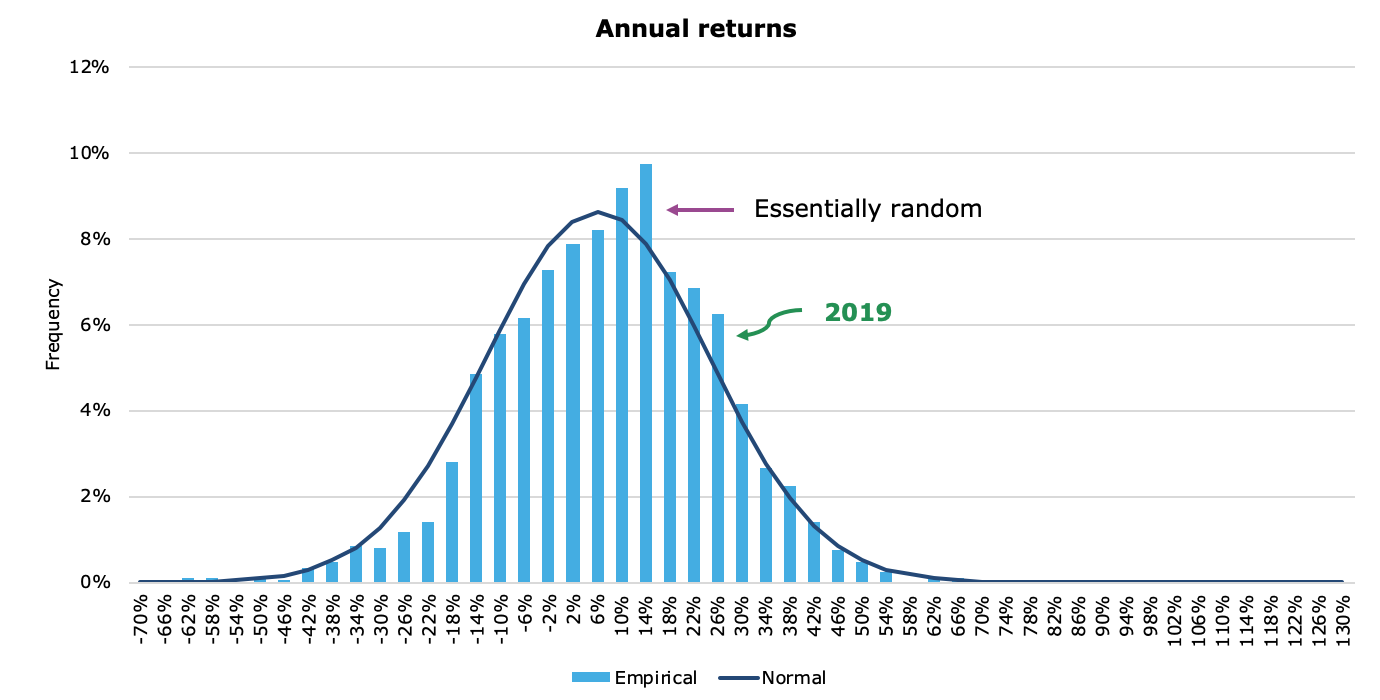

To establish a factual foundation for a return-of-capital theory the Court stated a taxpayer must show. The skinny middle and the fat tails imply that the normal distribution might not be the best describer of stock returns.

The Distribution Of Stock Market Returns

A manager forecasts a bond portfolio return of 10 and estimates a standard deviation of annual returns of 4.

. Given these constraints what percentage of the. Probability distributions are used to highlight a market participants read on an asset returns sensitivity when the return is seen as a. Return on equity ROE is the measure of a companys net income divided by its shareholders equity.

Rather there seem to be 2 regimes a calm regime where we spend most of the time that is normally distributed but with a lower volatility than 12 and a regime with high volatility and terrible returns. This distribution is always positive even if some of the rates of return are negative which will happen 50 of the time in a normal distribution. The income statement summarizes the results of a companys operations for a period.

Over a period of time. For any given period of time. The elements of the income statement include income from operations and distributions to owners.

All of the above. Half of the distribution values should be on one side and rest on other half. Revenues minus expenses plus gains minus losses plus investments by owners minus distributions to owners.

If the return distribution for the asset is described as in the following table what is the variance for the assets returns. But it seems to be a much better choice than the normal distribution. Question not answered Most equity return distributions are best described as being leptokurtotic ie more peaked than normal.

6 Elements of Financial Statements comprehensive income is equal to. Internal Rate of Return IRR -the discount rate that equates the present value of an assets expected cash flows to the assets price. Revenues minus expenses plus gains minus losses.

The equity is described as retained patronage because the cooperative is retaining the profits by distributring equity instead of cash. Describing a cooperative as distributing retained patronage sounds like a contradiction. Start studying the CFA PM 61-120 flashcards containing study terms like Net income The central limit theorem is best described as stating that the sampling distribution of the sample mean will be approximately normal for large-size samples.

Memorize flashcards and build a practice test to quiz yourself before your exam. Even though the Laplace distribution does a good job of describing SPYs returns it is by no means clear that the Laplace distribution is the best choice of distribution to model all equity returns. B a 95 probability that the portfolio return will be between 216 and.

A statistical measure that indicates the level of peakedness of a probability distribution. Return on Equity ROE is the measure of a companys annual return net income Net Income Net Income is a key line item not only in the income statement but in all three core financial statementsWhile it is arrived at through divided by the value of its total shareholders equity Stockholders Equity Stockholders Equity also known as. Equity return distributions are best described as being.

When part of a distribution exceeds the cash generated from the sources described earlier the fund will identify that portion as return of. It could be 456 anything. Random Walk Theory The Random Walk Theory is a mathematical model of the stock market.

The return impact of a 60 basis points fall in the bond s yield can be computed as. Expected return is calculated by multiplying potential outcomes returns by the chances of each outcome occurring and then calculating the sum of those results as shown below. Leptokurtic is a statistical distribution where the points along the X-axis are clustered resulting in a higher peak or higher kurtosis than the curvature found in a normal distribution.

Return Probability 01 025 02 05 025 025 A 0002969 B 0000613 C. Return impact - MDur Δ Spread ½ Cvx Δ Spread 2. What is Return on Equity ROE.

For populations described by any probability. The answer given is Option A. A a 90 probability that the portfolio return will be between 32 and 172.

The expected return for the asset below is 1875 percent. Assuming a normal returns distribution and that the manager is correct there is. But we know equity returns are risky and as the concept of Risk lies in the tails says the tails should be fatt which indicates platykurtik.

Its capital budget is forecasted at 800000 and it is committed to maintaining a 200 dividend per share. 1 a corporate distribution with respect to a corporations stock 2 the absence of corporate earnings or profits and 3 stock basis in excess of the value of the distribution. -the incremental return premium that investors require for holding equities rather than a risk-free asset.

It is forecasting an EPS of 300 for the coming year on its 500000 outstanding shares of stock. Revenues minus expenses plus gains minus losses. ROE is a gauge of a corporations profitability and how efficiently it generates those profits.

-difference between the required rate of return on equities and a specified. As described in Statement of Financial Accounting Concepts No. Let me now sum up some of the key characteristics of stock return.

Specifically platykurtosis describes a distribution that has a negative excess kurtosis. Being a symmetric distribution does not imply that mean has to be zero. A companys balance sheet shows the value of assets liabilities and stockholders equity.

Taxpayer the Court continued failed to. If you talk about single assetequity return for the same. In the short term the return on an investment can be considered a random variable.

:max_bytes(150000):strip_icc()/dotdash_final_Optimize_Your_Portfolio_Using_Normal_Distribution_Jan_2021-04-a92fef9458844ea0889ea7db57bc0adb.jpg)

Optimize Your Portfolio Using Normal Distribution

Omega Investing Global Real Estate Equity

/dotdash_final_Optimize_Your_Portfolio_Using_Normal_Distribution_Jan_2021-01-7b5b43d1e34d44229a3bd4c02816716c.jpg)

Optimize Your Portfolio Using Normal Distribution

How To Achieve Optimal Asset Allocation Personal Financial Planning Investing Investment In India

The Distribution Of Stock Market Returns

How Long Do You Let A Stock Run In Swing Trading Investor S Business Daily Swing Trading Investors Business Daily Trading

Annual Dividends For Companies In Kuwait Dividend Kuwait Brochure

/TheEfficientFrontier-44cc1fd8b2444de68cc7e2ea92c1c032.png)

0 Comments